Poll: 61% of Americans Oppose Debt Limit Hike or Want It Tied to Spending Cuts

Daily Signal - Tuesday October 27, 2015

by Rob Bluey

Speaker John Boehner stepped to the podium this morning to proclaim that he listened to the American people when crafting his budget deal with President Barack Obama.

56% of Americans would shut down the government to achieve spending cuts.

“Having listened to our members and listened to the American people, we have a budget agreement,” Boehner said. “This is a good deal for our troops and for the American people.”

But according to a new Associated Press-GfK poll, the American people are on the opposite side of Boehner when it comes to the debt limit and spending. A majority of those polled, 61 percent, either oppose a debt limit increase or want Congress to cut spending in tandem.

There’s even a majority of Americans who would shut down the government to achieve spending cuts.

Here are the key numbers in the poll:

- 50 percent agree with the view that “Congress should ONLY increase the debt ceiling if it makes significant spending cuts at the same time, even if that means there will be considerable reductions in government services and programs.”

- 11 percent believe that “Congress should NOT increase the debt ceiling under any circumstances, even if that means the U.S. defaults on its debt.”

- 56 percent say reducing government spending is “so important that it would be worth shutting down the government to achieve it.”

The Obama-Boehner deal would boost the $18.1 trillion debt ceiling by at least $1.5 trillion. It also increases spending by an estimated $80 billion, busting the budget caps put in place in 2011.

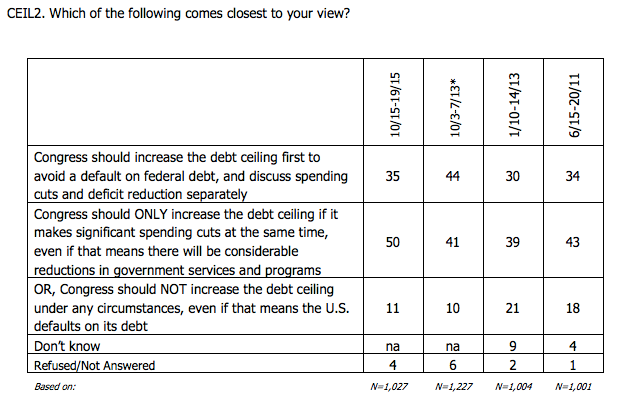

AP-GfK released the topline data from the poll. Here’s a closer look at the debt limit question:

The poll was conducted between Oct. 15-19 with 1,027 adults. It has a margin of error of plus or minus 3.3 percentage points.

The post Poll: 61% of Americans Oppose Debt Limit Hike or Want It Tied to Spending Cuts appeared first on The Daily Signal.

Read More Here

No comments:

Post a Comment